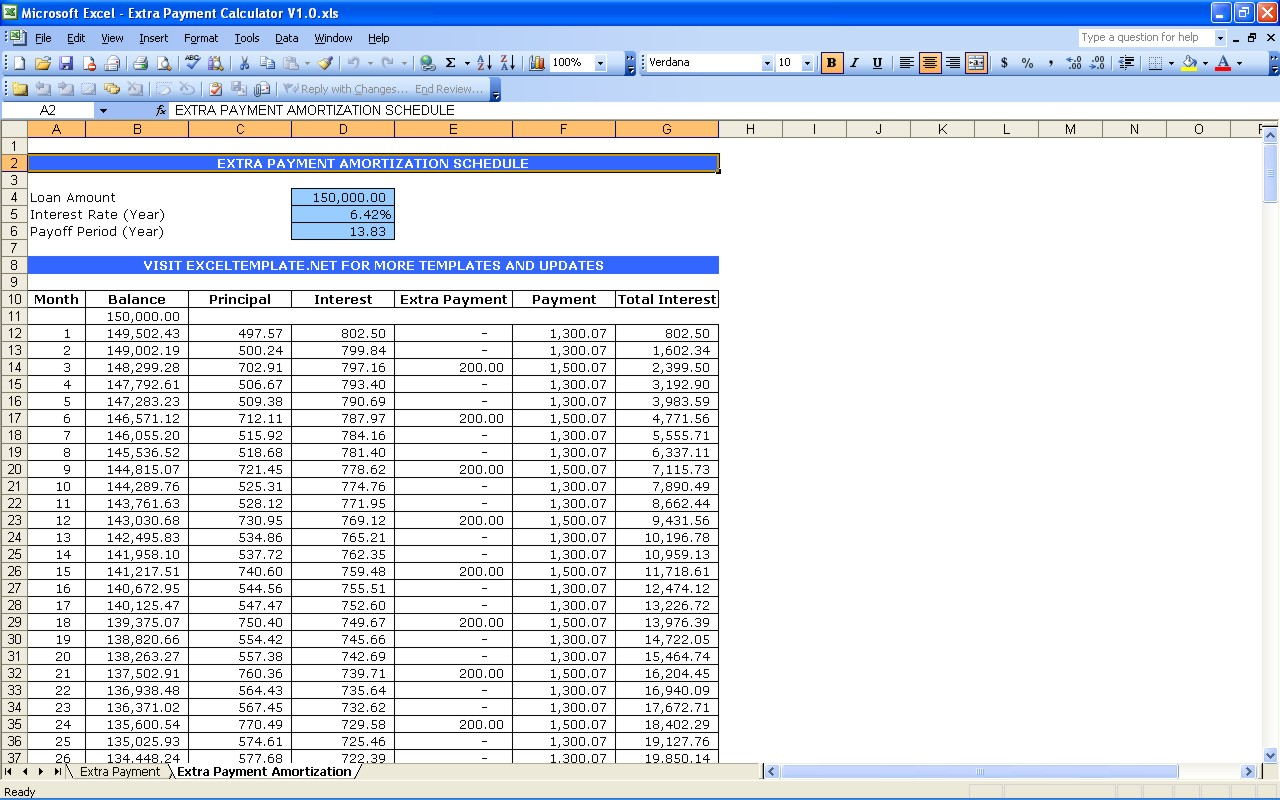

In any case, before you start making weekly mortgage payments, be sure to check with your home loan company to make sure your principal prepayments will be applied to the balance as you make them - free of any prepayment penalties. While some of these companies will simply escrow your prepayment and apply payments as they were scheduled (giving you "the finger" for your early payoff attempt), the more dastardly among them will go so far as to charge you a penalty for prepaying the principal. Since switching to weekly payments results in the prepayment of principal ahead of the original home loan terms, there are numerous, unscrupulous mortgage companies out there that take offense to you cutting into the massive year-end bonuses they have promised to their executives. Beware of Excessively Greedy Mortgage Companies The extra payment options are a one-time extra payment, recurring biweekly, monthly, quarterly, and yearly plan. The above formula is the one used by the weekly mortgage payment calculator on this page, which results in making the equivalent of 14 monthly payments per year. The mortgage calculator with extra payments gives borrowers four ways to include extra payments for their payments in case they want to pay off their mortgage earlier. The bi-weekly payments are set to half of the original monthly payment, which is like paying an extra monthly payment each year to pay off the loan faster. Weekly payment = Monthly payment x 14 ÷ 52 This calculator will help you to compare the costs between a loan that is paid off on a bi-weekly payment basis and a loan that is paid off on a monthly basis. In other words, your weekly mortgage payments would be calculated as follows: Therefore, to significantly increase your bi-weekly mortgage interest savings when switching to a weekly repayment method, you would need to look at making the equivalent of 14 monthly payments per year instead of the 13 you would make using the bi-weekly payment method. However, if you divide your monthly payment by 4 and pay that result on a weekly basis, you will see that the annual total of your 52 weekly payments would be identical to making 26 bi-weekly payments. Now you would think that we could double the savings if we use the same process to switch from monthly payments to making weekly mortgage payments. This will result in making 26 bi-weekly payments per year, which is the equivalent of making 13 monthly payments per year instead of 12. We also offer three other options you can consider for other additional payment scenarios. The mortgage prepayment calculator helps you find how much you save by increasing your mortgage payment. One way to do that - while hardly noticing the increase - is to simply make 1/2 of your monthly house payment every two weeks. This calculator allows you to enter an initial lump-sum extra payment along with extra monthly payments which coincide with your regular monthly payments. To save a large chunk of time and interest, you need to increase the annual total of your payments. This is because the annual total of your weekly mortgage payments will be close to the same as the annual total of your monthly payments. We can also express the first formula in terms of the daily wage.If you simply enter the terms for a new home loan into the weekly mortgage payment calculator, you will note that you may only save a couple of hundred dollars by choosing to repay the home loan using weekly mortgage payments vs. Remembering that the weekly wage is the hourly wage times the hours worked per week:īiweekly wage = 2 × Hourly wage × Hours per week

Learn the benefits and disadvantages of paying off your mortgage faster. Therefore, we can calculate the biweekly income as twice the weekly wage:įor a wage earner who gets paid hourly, we can calculate the biweekly salary from the formula above. Easily calculate your savings and payoff date by making extra mortgage payments. We know biweekly pay occurs every two weeks. Current biweekly payment (principal and interest only) Interest - A percentage of the principal you pay for borrowing over time. Interest Rate - The percentage cost of the principal borrowed. Principal Balance - The loan amount you borrowed. Depending on the available information, there'll be different ways to calculate the biweekly pay: Let’s say you have a 220,000, 30-year mortgage with a 4 interest rate. Results are based on the assumption that the original mortgage repayment period is 30 years.

0 kommentar(er)

0 kommentar(er)